Applying for a business loan can be a turning point for any small or medium enterprise. Whether you’re looking for working capital, expanding operations, purchasing equipment, or managing seasonal cash flow, a loan can offer the support your business needs. But before lenders decide to extend credit, they carefully evaluate your Business Health Score. This score is essentially a mirror of your financial discipline, business performance, and repayment capability.

Understanding your Business Health Score before applying for a loan not only improves your chances of approval but also helps you negotiate better interest rates and repayment terms. In this guide, we explain what the score means, how to check it, and how you can improve it.

What Is a Business Health Score?

A Business Health Score is a comprehensive evaluation of your company’s financial and operational strength. Lenders use it to understand:

-

- How consistent your cash flow is

-

- How reliable your repayment history has been

-

- Whether your business is stable and compliant

-

- What risks may exist in lending to you

This score is derived from several data sources, such as:

-

- Bank statements

-

- GST returns

-

- Income Tax Returns (ITR)

-

- Credit bureau reports

-

- Business financials

-

- Existing loan obligations

A strong score signals a trustworthy borrower, while a weak score raises concerns about repayment capability.

Why Your Business Health Score Matters for Loans

Your Business Health Score plays a crucial role in determining:

-

- Whether your loan gets approved

-

- How much you can borrow

-

- What interest rate you receive

-

- How fast your loan gets processed

A high score often results in faster approvals and better loan terms. A low score may lead to rejections or a request for additional collateral.

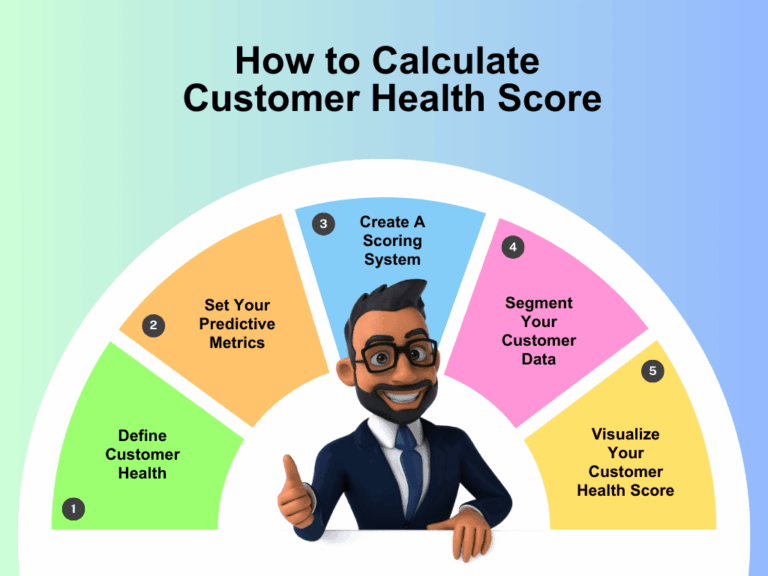

How to Check Your Business Health Score

Checking your Business Health Score is not complicated. Below are the key components lenders evaluate and what you should review before applying for a business loan.

1. Review Your Bank Statements

Your bank statement offers the clearest picture of your daily business activity. Lenders look at:

-

- Monthly turnover

-

- Regular credits and cash inflows

-

- Average monthly balance

-

- Cheque bounces or debit returns

-

- Cash vs digital transactions

Businesses with stable cash flow and fewer irregularities typically receive higher scores. If your bank statement shows healthy activity, your loan eligibility increases immediately.

2. Check Your Credit Bureau Score

Your credit score is a major factor in loan approval. For proprietorships, lenders consider the promoter’s personal credit score. For companies and LLPs, they check both the business credit report and the directors’ scores.

A score of:

-

- 750+ is considered excellent

-

- 700–749 is good

-

- 650–699 is acceptable but may require stronger documentation

-

- Below 650 may result in rejection

Look for issues such as overdue EMIs, high credit card utilization, past settlements, or errors in your credit report. Addressing these can significantly improve your Business Health Score.

3. Monitor Your GST Filings

GST data is a reliable indicator of business turnover and compliance. Lenders review your GST filing history to check:

-

- Filing regularity

-

- Annual and monthly turnover

-

- Invoice matching and tax payments

-

- Sudden drops in sales

Timely and consistent GST filings portray a stable business and increase your borrowing capacity. Delays, mismatches, or irregular filings can negatively affect your score.

4. Analyze Your Income Tax Returns (ITR) and Financial Statements

Your ITR is a declaration of your business’s financial performance. Lenders examine:

-

- Annual turnover

-

- Net profit

-

- Depreciation and expenses

-

- Tax compliance

-

- Financial ratios

Two metrics matter most:

-

- Profitability → shows your ability to repay

-

- DSCR (Debt Service Coverage Ratio) → shows whether you can handle additional EMI burden

Higher profits, clean financials, and timely filings contribute to a better Business Health Score.

5. Evaluate Existing Loan Obligations

Your current debt load directly affects how much you can borrow. Lenders calculate a ratio called FOIR (Fixed Obligations to Income Ratio) to ensure you don’t have excessive EMI commitments.

To strengthen your score:

-

- Close small loans

-

- Avoid multiple loan applications at once

-

- Keep credit card utilization under control

-

- Pay EMIs on time

Lowering your debt burden increases your eligibility for new credit.

6. Use a Professional Business Health Report

Manually reviewing these parameters can be time-consuming and confusing. Many businesses prefer to use a Business Health Report, which consolidates:

-

- Banking analytics

-

- GST records

-

- Credit data

-

- Turnover trends

-

- Eligibility insights

-

- Risk indicators

This report gives you a clear, lender-friendly overview and highlights what needs to be improved before applying for a loan.

How to Improve Your Business Health Score

If your score isn’t where you want it to be, here are proactive steps to improve it:

-

- Maintain steady bank balance and turnover

-

- Reduce cheque bounces and NC transactions

-

- File GST and ITR on time

-

- Close unnecessary loans

-

- Rectify errors in your credit report

-

- Reduce credit utilization

-

- Increase digital payments

-

- Track cash flow efficiently

Even modest improvements can significantly strengthen your loan application.

Conclusion

Your Business Health Score is one of the most important factors in securing a business loan. By checking and understanding this score, you can approach lenders with confidence, avoid unnecessary rejections, and negotiate better loan terms.

A clear evaluation of your banking, GST, credit history, financials, and debt obligations gives you a strong foundation before applying for credit. With the right insights and improvements, your business can secure the financial support it needs to grow.

Weekly News

What's New

Today's Hot

Popular News

Follow Us On